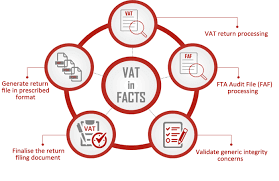

VAT Accounting Requirements in UAE

Globally VAT requirements are distinct in different

countries in the world. These VAT

regulations can be changed at any point of time and companies registered under

VAT are ready to update these changes. Sometimes it become a challenge for

companies to incorporate this changes in their system. Being a Tax Accredited Software (TAS) in

UAE our functional experts are ready

to steer you in all types of VAT concerns.

Once you are registered under VAT in UAE, you must file your

periodic legal declarations monthly or quarterly to Federal Tax Authorities. It

is a transparent summary of all transactions based on the business executed in

specific period which contains VAT assent in all financial transactions.

Each

VAT return is distinct in nature and contains different information and

provisions based on the type of business. Facts is well aware off these process

and we know the complete guidelines and information’s for filing VAT returns in

UAE. For filing return it requires solid

knowledge of local tax legislation policies and procedures. Any discrepancies

from these fundamental prerequisites will attract huge penalties. For avoiding

these discrepancies, we have to keep all VAT invoices for a period of 5 years.

FTA can ask these invoices for verification at any point of time. Facts Billbox

is a wonderful solution for this.

Being a TAS software

we are also providing free consultancy for the same.

Why Facts?

- FTA accredited software

- Cost effective

- Completely customizable

- Biggest team in Dubai

- 20+ years of experience

- Microsoft Gold certified partner of the region.

- Microsoft certified professionals

- Strong knowledge in VAT filing process

- More than 2000+ clients in Trading, Manufacturing and Contracting domain

- Dedicated support team to address client’s concerns

- Easy to file VAT returns

Comments

Post a Comment